How Caldic transformed its treasury function with a new TMS

Caldic’s adoption of Salmon Treasurer helped the business to standardise processes and grow with scale, freeing up its treasury function to become a strategic part of the business

The world is changing: despite the pandemic, the cost of living crisis, the horrors in Ukraine, and the rising spectre of inflation, the business outlook for many companies remains extremely positive. Many are expanding and whatever short-term difficulties there might be, in the longer term, many are expected to grow and thrive. But this has created several problems across the global economy, for while companies grow, their treasury systems are often very out of date.

While spreadsheets had their day, they are not sufficient to cope with a huge multi-national corporate’s (or even a smaller one) treasury needs. Other companies are plagued with too-small treasury teams or an ever-complex setup which means several companies require bespoke treasury management systems (TMS).

But even for the most well-established treasury teams, let alone those of start-ups and new entrants, it can be difficult to know where to start. Company needs vary enormously and there is no size fits all approach. So, what are the challenges, how did they arise, and what should a corporate do when their business is growing, and previous systems are no longer adequate for the job?

In 2017, Caldic, which provides inspiring solutions in life sciences and specialty chemicals, focussing on life sciences (food, pharmaceuticals and consumer care) and industrial formulation markets, was bought by a private equity company. This transformed the business into a more centralised organisation, dramatically changing its treasury needs in the process. Previously local management teams had been encouraged to take responsibility for their own profit and loss as well as funding and liquidity management, but now increased debt levels required Caldic to set up a central treasury function. Something had to change.

In 2017 Bas Baaten started as a Caldic’s first Treasury Manager in history, to ensure Caldic remained within the adequate liquidity spot and central debt servicing. After setting up a global cash pooling structure and an excel based short-term cash flow forecasting process, Caldic was ready for a next step.

Now it needed standardisation and automation, with a treasury management system that mirrored its move from essentially a family-run company to a private equity-funded level of entrepreneurship. Economic growth, fuelled by an expansion into developing markets, also spurred the need for change, specifically for a more in-depth and detailed cash overview, cash pooling, cash positioning and cash flow forecasting.

Choosing the right provider

The first need to be recognised was the need to move from local management to a more harmonised way of working. The company was expanding and needed to update its processes by implementing a system that would run the day-to-day operations. But there were challenges.

For a start, as in any company making huge shifts in how it operates, in particular the shift of taking the autonomy of the local management to arrange domestic credit lines and funding to group treasury. Although supported by cash pooling, dozens of IC loans and ample administration of those movements occurred, including the accrued interest calculations. Everyone wanted to know ‘where and when is the cash?’ Following that, Caldic had to consider which software provider was the right fit for its business. Flexibility was the key: given Caldic was in full growth mode, any software needed to ensure it could grow and adapt with the company. At the time of making its software decision, it was making acquisitions of small companies, while merging with a similar-sized peer based in Latin America. The merger of two different entities, combined with the ongoing acquisition programme shows that it is crucial to get a firmer grip and control of processes to stay on top of its cash positions and visibility.

It was becoming increasingly complex with every acquisition, and full visibility was needed, along with the ability to have daily reporting and monthly profit and loss statements. In the wider economy, cash was also becoming more expensive, another element that had to be factored in. At the same time, any new treasury software provider would also need to cope with existing processes and procedures that could not be changed overnight.

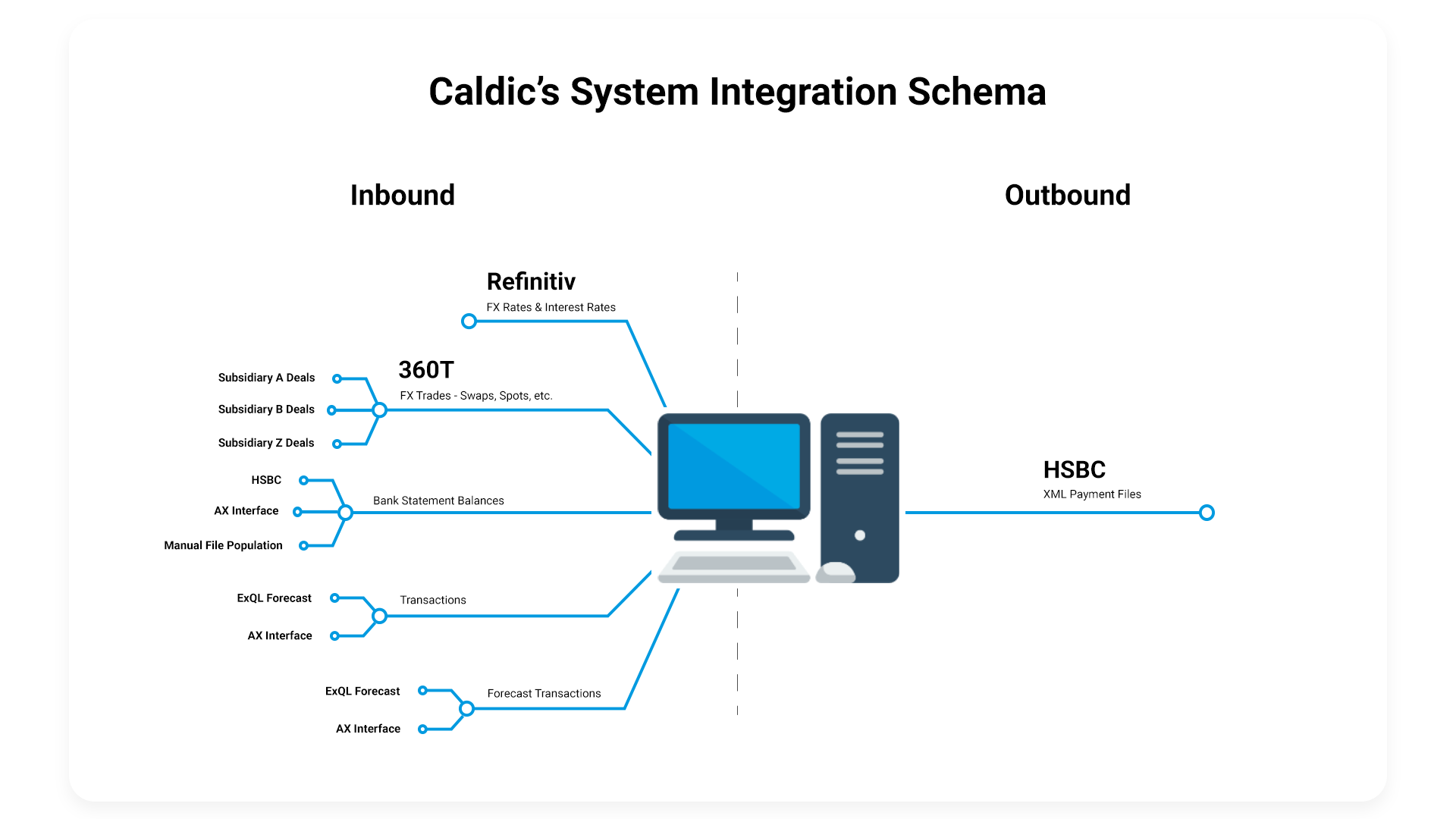

The specific needs for applications centred on visible cash management with real time reposting and interfacing with bank portals. There was a requirement to centralise FX hedging, including central execution and deal capturing, which included an automated settlement process. Forecasting played an important role too, including data aggregation and data analysis over different time periods (weekly, monthly, and annually), comparing it to the allotted budgets. Another important function was monitoring positions and risk exposures, both on the FX and intercompany (IC) loan administration front. Caldic also required there to be an audit function, third-party account for future changes to payment processing on the FX side.

After reviewing several potential providers, Caldic opted to partner with Salmon Software. A boutique TMS provider, Salmon offered to provide Caldic with the individual attention required during a treasury overhaul. Unlike much of the competition, the company was able to offer a TMS that would fit with Caldic’s needs, as opposed to the other way around.

Many systems offer a prescribed way of working, a variation of Henry Ford’s dictum about the cars he would sell: “Any colour as long as it’s black.” To avoid that Caldic’s short list would be restricted to TMS systems that Bas worked with before in his career, Bas decided to team up with Dutch based Treasury consultants Orchard Finance. After discussing Caldic’s functional and technical requirements, a TMS vendor selection process was executed. Several TMS vendors were identified as possibilities, but in the end, it was Salmon that won through.

The reasonable price and quality of the option of course played a role, but perhaps the most important element was the flexibility in both the software and with regards to flexible implementation approach. During weekly progress calls between Caldic, Orchard Finance and Salmon, implementation progress was monitored, and workload adjusted to Bas Baaten’s availability. Flexible interfacing was based off Microsoft’s cloud hosting service, Azure, allowing Caldic to operate in a separate environment, while also providing the ability to aggregate various sources to maximise efforts. Scalability, when new acquisitions are made, is also part of the system. Both incoming and outgoing sources can work with any file format required. Interfaces can be automated meaning no user intervention, while it also provided better cash visibility, making it easier to have in-depth insights on cash positions.

Perhaps the biggest benefit of the new TMS was it freed Treasury Manager Bas Baaten from the minutia of the day-to-day running of the function which gave him more time to concentrate on strategic decisions. It also allowed the treasury function to move from a reactive to a more pro-active approach.

The system also created a central connectivity point, important for a company rapidly expanding. Local finance directors were able to input data from their business and geographical area, which could then be used in a logical manner in the TMS. Specific tools across the board also supplied not just connectivity but conversion to make data standardised across the board. Furthermore, the TMS also made it possible to take data from other systems. A core reason for choosing Salmon was its user interface – Caldic needed a system existing subsidiaries could switch to without impacting their working practices. Salmons’ software did just that and allowed new subsidiaries – bought on through acquisition – to also latch on without problems.

Benefits enshrined

Since adopting Salmon’s platform, Caldic has seen its processes harmonised, centralised, standardised, and benefited from its scalability as it has continued to grow and acquire other companies. From the automation of cash flow reporting between the ERP and Salmon Treasurer, to improved visibility of the daily FX process workflow, Caldic’s treasury function has been enhanced.

The adoption of Salmon’s software has had an impact on Caldic’s bottom line. Treasury, who were previously bogged down with tediously manual tasks, can now take a greater role in the strategic decision-making so crucial to today’s treasury function. And this is only the beginning: Caldic plans to expand its treasury function further – as it does, new products will be needed.

TMS systems are crucial for today’s treasurers, but companies should take their time choosing the provider who is right for them. A provider should be there for implementation and be able to adapt its offering to each client’s specific needs, with an awareness software will need to evolve alongside economic conditions.